How are Intel’s customers weathering tariffs and a possible recession? By buying Intel’s older products, and not its latest chips.

Intel chief financial officer David Zinsner told analysts on Thursday that Intel sold more volume in its Raptor Lake chips than Lunar Lake, suggesting that customers preferred the higher-performance Raptor Lake chips that debuted in 2023 versus the latest Lunar Lake chip that launched last September.

Meanwhile, Zinsner suggested that Intel’s future is extremely uncertain, due to the Trump administration’s varying economic policy. “The very fluid trade policies in the U.S. and beyond, as well as regulatory risks, have increased the chance of an economic slowdown with the probability of a recession growing,” Zinsner said. “This makes it more difficult to forecast how we will perform for the quarter and for the year, even as the underlying fundamentals supporting growth I discussed earlier remain intact.”

Zinsner also gave an enormous range for the company’s spending plans of between $8 billion and $11 billion, because Intel doesn’t know what the future of the CHIPS Act might be.

Older, cheaper, higher-performance Intel CPUs are the favorite

The surprise, however, was how Intel’s customers are dealing with tariffs — simply buying older products instead. Intel executives said that the Intel 7 process — the foundation of the Raptor Lake chips — was constrained, and so was production of the chip itself. That’s because customers are snapping up older Intel CPUs that compete with or even beat Intel’s latest parts.

Intel didn’t specify whether it was desktop PC customers or laptop customers who preferred Intel’s older parts.

Intel

Michelle Johnston Holthaus, who returned to her role as head of Intel Products after serving as the company’s co-CEO for the period after former chief executive Pat Gelsinger stepped down, explained that customers were preferring “N-1” products, or the new code for older parts.

“What we’re really seeing is much greater demand from our customers for N-1 and N-2 products so that they can continue to deliver system price points that consumers are really demanding,” Holthaus said. “As we’ve all talked about, the macroeconomic concerns and tariffs have everybody kind of hedging their bets in what they need to have from an inventory perspective. And Raptor Lake is a great part.

“Meteor Lake and Lunar lake are great as well, but come with a much higher cost structure, not only for us, but at the system price points for our OEMs as well,” Holthaus added. “And so as you think about an OEM perspective, they’ve also, you know, ridden those cost curves down from a Raptor Lake perspective, and it allows them to offer that product at a better price point. So I really just think it’s, you know, macroeconomics, the overall economy, and how they’re hedging their bets.”

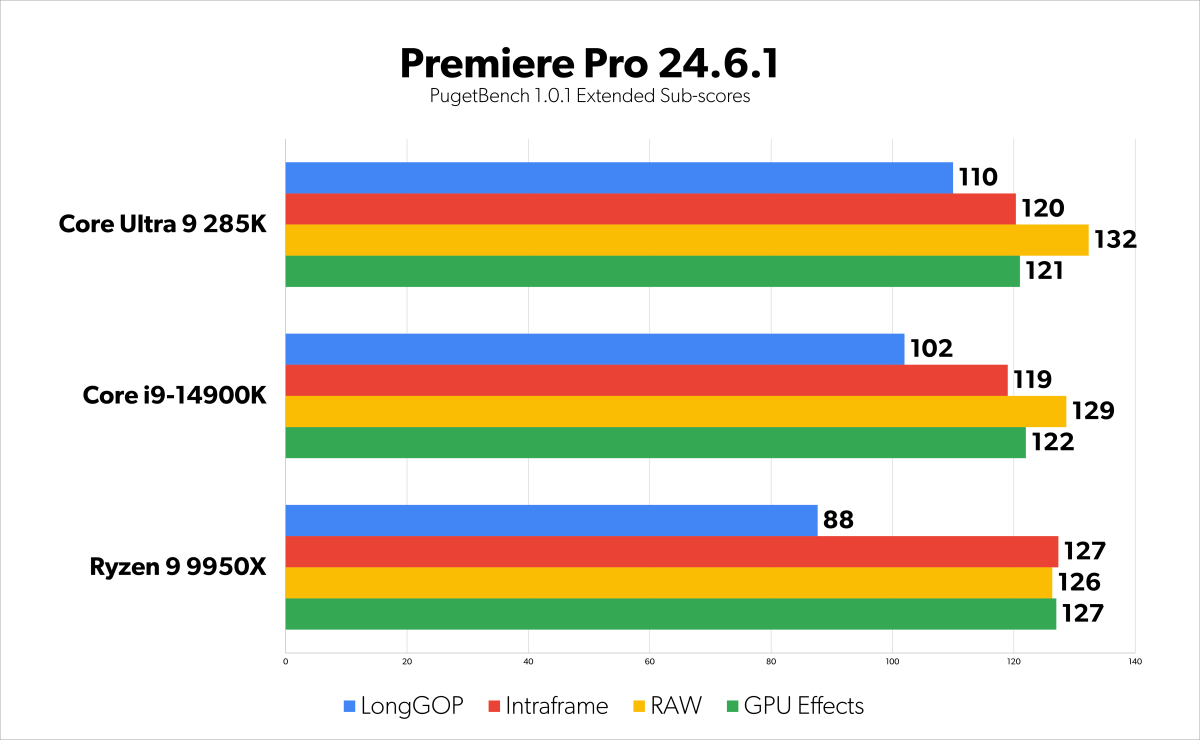

That’s not that surprising. The relatively anemic performance of Intel’s latest Core Ultra 200-series parts was matched by an equally anemic reception. As our Arrow Lake desktop review showed, Intel’s 15th-generation Arrow Lake desktop parts basically offered the performance of Intel’s Raptor Lake generation.

Adam Patrick Murray & Will Smith / PCWorld

What does this mean for Panther Lake?

Meanwhile, Intel is readying the launch of Panther Lake and its 18A technology for later this year. Lip-Bu Tan, in his first earnings call as Intel’s chief executive, said that Panther Lake would be available before the end of the year, but Zinsner said that the bulk of shipments would be in 2026. So will customers buy Panther Lake, if they skipped over the previous two chips, Bernstein analyst Stacy Rasgon asked.

“The Panther Lake launch matches exactly what we did on both Meteor Lake and Lunar Lake in regards to timing,” Holthaus said, effectively refuting that the launch would be delayed. “So it’s very aligned with how customers like to take products to market.

Mark Hachman / IDG

“Panther Lake is a great product, both from a performance and price perspective for customers,” Holthaus added. “So I think you’ll see a strong uptake of that product, right? We still see very strong commercial demand for AI PCs as [customers are] deploying their fleets, as they’re doing their upgrades, they want to future-proof their products and have that AI capability. So I don’t think you’re going to see that change in commercial. And if you look at our traditional ramps for these types of products, we tend to go faster in commercial first, and then consumers come on board. And so we’ll have to balance, where is the economy at the end of the year, but I feel very bullish about the Panther Lake product and our customer feedback.”

Holthaus said that Intel’s goal is to bring 70 percent of all the silicon used in Panther Lake in-house, or manufactured at Intel’s fabs. With Nova Lake, Intel 2026 processor architecture, Intel will try to move even more onto Intel foundries. “When you look at the aggregate of Nova Lake, we will build more wafers on Intel process than we are on Panther Lake,” Holthaus said.

Essentially, Intel’s priorities are to build trust in Intel’s own manufacturing technologies, then extend that trust to winning more customers for Intel’s foundry business, Tan said.

When asked how long this would all take, Tan demurred. “There is no quick fix,” he said.

In a note shared publicly, Tan said that Intel will “remove organizational complexity” by removing layers of management, and requiring employees to work at the office four days a week or more.

Intel reported a GAAP loss of $800 million on revenue that was flat with a year ago, at $12.7 billion. Intel’s Client Computing Group recorded $7.6 billion in revenue, down 8 percent from a year ago.

How are Intel’s customers weathering tariffs and a possible recession? By buying Intel’s older products, and not its latest chips.

Intel chief financial officer David Zinsner told analysts on Thursday that Intel sold more volume in its Raptor Lake chips than Lunar Lake, suggesting that customers preferred the higher-performance Raptor Lake chips that debuted in 2023 versus the latest Lunar Lake chip that launched last September.

Meanwhile, Zinsner suggested that Intel’s future is extremely uncertain, due to the Trump administration’s varying economic policy. “The very fluid trade policies in the U.S. and beyond, as well as regulatory risks, have increased the chance of an economic slowdown with the probability of a recession growing,” Zinsner said. “This makes it more difficult to forecast how we will perform for the quarter and for the year, even as the underlying fundamentals supporting growth I discussed earlier remain intact.”

Zinsner also gave an enormous range for the company’s spending plans of between $8 billion and $11 billion, because Intel doesn’t know what the future of the CHIPS Act might be.

Older, cheaper, higher-performance Intel CPUs are the favorite

The surprise, however, was how Intel’s customers are dealing with tariffs — simply buying older products instead. Intel executives said that the Intel 7 process — the foundation of the Raptor Lake chips — was constrained, and so was production of the chip itself. That’s because customers are snapping up older Intel CPUs that compete with or even beat Intel’s latest parts.

Intel didn’t specify whether it was desktop PC customers or laptop customers who preferred Intel’s older parts.Intel

Michelle Johnston Holthaus, who returned to her role as head of Intel Products after serving as the company’s co-CEO for the period after former chief executive Pat Gelsinger stepped down, explained that customers were preferring “N-1” products, or the new code for older parts.

“What we’re really seeing is much greater demand from our customers for N-1 and N-2 products so that they can continue to deliver system price points that consumers are really demanding,” Holthaus said. “As we’ve all talked about, the macroeconomic concerns and tariffs have everybody kind of hedging their bets in what they need to have from an inventory perspective. And Raptor Lake is a great part.

“Meteor Lake and Lunar lake are great as well, but come with a much higher cost structure, not only for us, but at the system price points for our OEMs as well,” Holthaus added. “And so as you think about an OEM perspective, they’ve also, you know, ridden those cost curves down from a Raptor Lake perspective, and it allows them to offer that product at a better price point. So I really just think it’s, you know, macroeconomics, the overall economy, and how they’re hedging their bets.”

That’s not that surprising. The relatively anemic performance of Intel’s latest Core Ultra 200-series parts was matched by an equally anemic reception. As our Arrow Lake desktop review showed, Intel’s 15th-generation Arrow Lake desktop parts basically offered the performance of Intel’s Raptor Lake generation.

Intel’s Arrow Lake didn’t offer impressive performance.Adam Patrick Murray & Will Smith / PCWorld

What does this mean for Panther Lake?

Meanwhile, Intel is readying the launch of Panther Lake and its 18A technology for later this year. Lip-Bu Tan, in his first earnings call as Intel’s chief executive, said that Panther Lake would be available before the end of the year, but Zinsner said that the bulk of shipments would be in 2026. So will customers buy Panther Lake, if they skipped over the previous two chips, Bernstein analyst Stacy Rasgon asked.

“The Panther Lake launch matches exactly what we did on both Meteor Lake and Lunar Lake in regards to timing,” Holthaus said, effectively refuting that the launch would be delayed. “So it’s very aligned with how customers like to take products to market.

Intel’s Holthaus holds up a “Panther Lake” sample.Mark Hachman / IDG

“Panther Lake is a great product, both from a performance and price perspective for customers,” Holthaus added. “So I think you’ll see a strong uptake of that product, right? We still see very strong commercial demand for AI PCs as [customers are] deploying their fleets, as they’re doing their upgrades, they want to future-proof their products and have that AI capability. So I don’t think you’re going to see that change in commercial. And if you look at our traditional ramps for these types of products, we tend to go faster in commercial first, and then consumers come on board. And so we’ll have to balance, where is the economy at the end of the year, but I feel very bullish about the Panther Lake product and our customer feedback.”

Holthaus said that Intel’s goal is to bring 70 percent of all the silicon used in Panther Lake in-house, or manufactured at Intel’s fabs. With Nova Lake, Intel 2026 processor architecture, Intel will try to move even more onto Intel foundries. “When you look at the aggregate of Nova Lake, we will build more wafers on Intel process than we are on Panther Lake,” Holthaus said.

Essentially, Intel’s priorities are to build trust in Intel’s own manufacturing technologies, then extend that trust to winning more customers for Intel’s foundry business, Tan said.

When asked how long this would all take, Tan demurred. “There is no quick fix,” he said.

In a note shared publicly, Tan said that Intel will “remove organizational complexity” by removing layers of management, and requiring employees to work at the office four days a week or more.

Intel reported a GAAP loss of $800 million on revenue that was flat with a year ago, at $12.7 billion. Intel’s Client Computing Group recorded $7.6 billion in revenue, down 8 percent from a year ago. CPUs and Processors PCWorld