What happens when retail logs off from crypto and Wall Street tunes in? Looking at bitcoin’s BTC recent all-time-high, one would say it feels bullish and the industry is maturing.

That might as well be the case, but we might not be there yet. So before we floor our Lambos, let’s look under the hood.

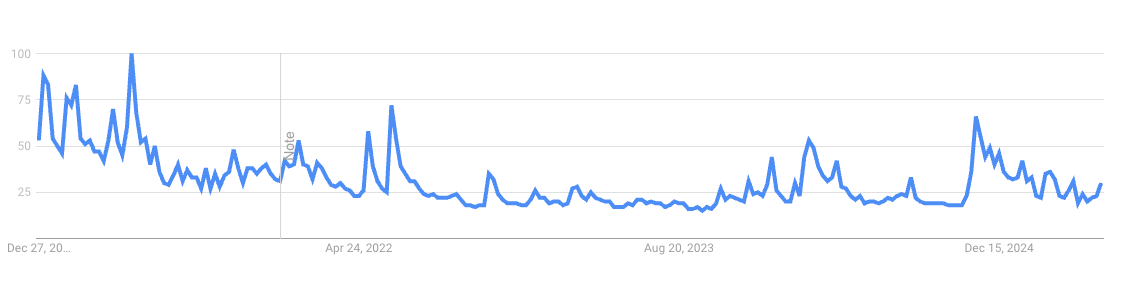

First things first, retail investors have basically ghosted this rally. A quick search on Google Trends using the keyword “bitcoin” shows that the surge that was seen back in 2021’s bull market is non-existent. Back then, everyone and their grandmothers were Googling bitcoin, aping into altcoins and flooding the social media with rocket emojis. In 2025? It’s a ghost town in retail-land.

There was a blip of high retail interest surrounding the U.S. presidential election, when a short-lived memecoin mania took over retail sentiment. However, that surge is long gone, as memecoin prices tanked swiftly, even as bitcoin hit an all-time high this week, ripping past $111,000.

“Early in this cycle, memecoins became a concentration of risky retail-driven trading with related trading peaking in January,” said Toronto-based crypto platform FRNT Financial. “However, since then, there has been a virtual wash-out of interest and memecoin trading activity,” which shows “the tepid risk appetite in crypto at the moment,” FRNT added.

Translation: “Wen Lambo” crowd got burned, and they aren’t rushing back into the race track en masse anytime soon.

From Lambos to Corollas

On the topic of risk appetite, let’s go back to the car analogy.

During the 2021 bull market, people bought unreliable performance cars, stripped out the brakes and seatbelts to go faster than ever before, and did not care that there might be engine blowouts. As long as there was a promise of reaching the moon, bullish vibes were all that mattered.

Now? After losing tremendous amounts of money on those unsustainable go-fast cars for years, traders are driving Toyota Corollas—sensible sedans that are slow but steady and still on the road.

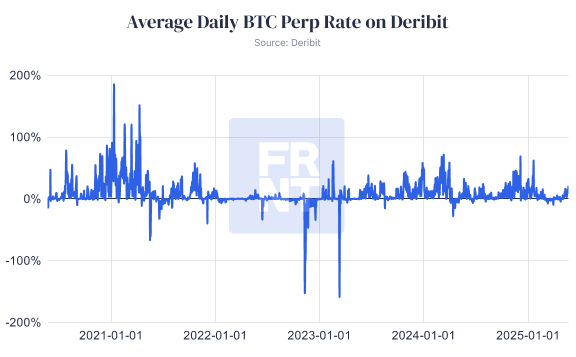

That risk-off sentiment is also evident from the funding rates, according to FRNT’s analysis of BTC perp rates—a measure of how much traders are willing to pay to maintain their long positions. When bitcoin reached a record high of around $42,000 in January 2021, the perp rate was about blistering 185%. Today, at bitcoin near $110,000, the rate is near 20% on crypto options exchange Deribit, meaning the risk appetite isn’t completely gone but nowhere near the 2021 frenzy.

ATH jitters

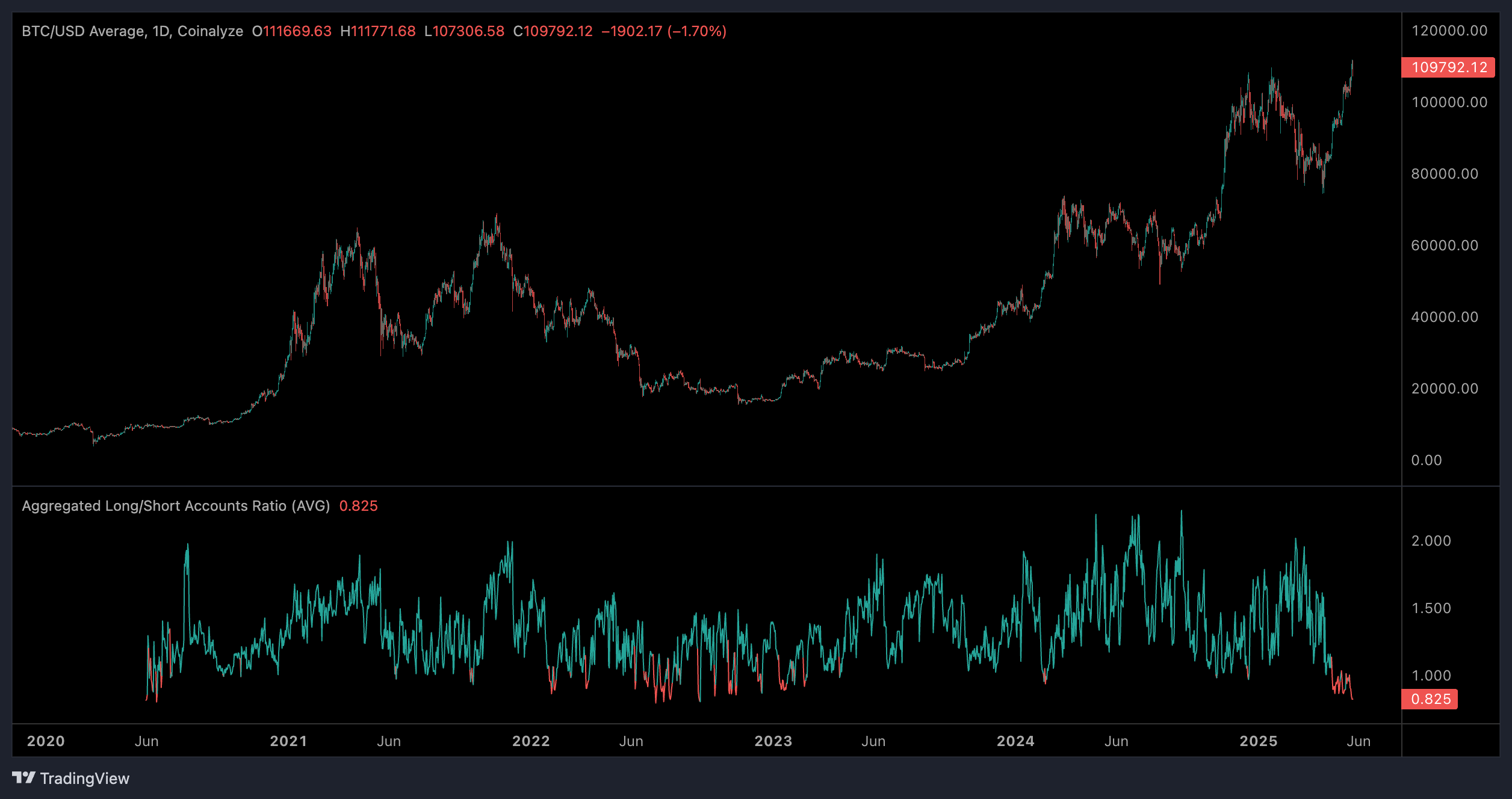

A third point to add is the high number of short positions in the market.

As CoinDesk’s Oliver Knight reported this week, the bitcoin long/short ratio is at its lowest point since the crypto winter in September 2022. This implies that the majority of the traders aren’t completely buying into this recent positive momentum and betting on bitcoin moving lower as a hedge for the new bullish rally.

The impact of such positioning was clear on Friday, when bitcoin swiftly crashed from near $111,000 to $108,000 in a matter of minutes and then bounced right back up to $109,000. The anxiety of a swift volatility is real.

So in a car-themed analogy, the drivers (in this case, investors) are still taking out their super-modified, unreliable sports cars for a weekend drive on the track. Still, they also have their Corollas following along. Just in case the engine blows on their go-fast cars.

Cautious optimism

Given the current macro-risk, it’s not entirely surprising that investors are on their toes and risk-averse. But this might just be exactly what your mechanic at the shop prescribed. In fact, this might be an indicator of a sustainable rally in the long term.

“Periods of low leverage and risk appetite in crypto have often preceded further sustainable gains,” according to FRNT.

“BTC appears to be in such a phase, set against a backdrop of numerous bullish catalysts and narratives,” the firm added.

The bottom line is that the retail Lambos might have been towed away, but big money is stepping in with their everlasting Toyotas. This might start a slow but steady race to the moon, not just a reckless joyride.

Bitcoin hit new highs, but retail investors remain on the sidelines while institutional money fuels the steady rally. Markets, Bitcoin, market analysis, Funding rate, News CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data