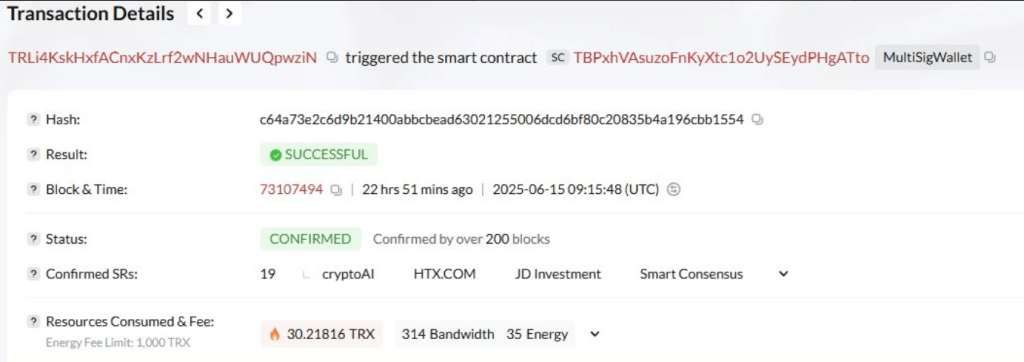

Tether acted swiftly Sunday when it froze $12.3 million worth of USDT on the Tron blockchain. Based on reports from Tronscan, this step targets wallets allegedly linked to money laundering and sanctions evasion. The company has not issued a public statement yet, but on‑chain data left little room for doubt.

T3 Financial Crime Unit Shows Muscle

According to Tether, its T3 Financial Crime Unit (FCU) partners with Tron and TRM Labs to track suspect transactions in real time. Since late 2024, the FCU has frozen over $126 million in questionable assets.

In the last quarter of that year alone, $100 million was blocked. This suggests a sharp uptick in enforcement efforts just as regulators worldwide tighten the screws.

LATEST: Tether freezes $12.3M in $USDT tied to suspicious TRON addresses. pic.twitter.com/WJr2ApEfyp

— MrRebel.eth (@rebelethpromos) June 16, 2025

Targeting High‑Risk Entities On Sanctions List

Following regulatory synchronization with the US Treasury’s Office of Foreign Assets Control (OFAC), Tether regularly blacklists wallets associated with sanctioned entities. Individuals on the Specially Designated Nationals (SDN) list are the natural targets.

In March 2025, for example, Tether froze $27 million worth of USDT on the Russian-linked exchange Garantex following the EU’s 16th package of sanctions. Garantex later suspended services and claimed that over 2.5 billion rubles of user funds were held up.

Lazarus Group Faces $374K Blacklist

Reports show that North Korea’s Lazarus Group has moved more than $3 billion in stolen crypto since 2009. In November 2023, Tether blacklisted $374,000 in USDT tied to Lazarus‑associated addresses.

Other stablecoin companies joined together to lock up $3.4 million in identical wallets. These numbers highlight how large issuers can upset state-sponsored hacking groups.

Diversifying With Gold Royalties

Tether diversified beyond digital currency on June 12, 2025, by buying a 32% equity stake in Elemental Altus Royalties. The deal involved the purchase of over 78 million shares at CAD1.55 per share, valued around $89 million.

This move to become a public gold royalty company shows Tether’s commitment to backing its stablecoin with real assets. It also shows an effort to appease risk-averse regulators that demand strong reserves.

A Dual Approach To Stablecoin Governance

As per Tether executives, this combination of tough enforcement and asset diversification can become a new benchmark. By freezing criminal funds and backing USDT with real-world value, Tether aims to strengthen confidence in its stablecoin.

Featured image from Unsplash, chart from TradingView

Tether acted swiftly Sunday when it froze $12.3 million worth of USDT on the Tron blockchain. Based on reports from Tronscan, this step targets wallets allegedly linked to money laundering and sanctions evasion. The company has not issued a public statement yet, but on‑chain data left little room for doubt. Related Reading: Amid Bitcoin Hype, Seasoned Trader Predicts Sudden Drop To This Level T3 Financial Crime Unit Shows Muscle According to Tether, its T3 Financial Crime Unit (FCU) partners with Tron and TRM Labs to track suspect transactions in real time. Since late 2024, the FCU has frozen over $126 million in questionable assets. In the last quarter of that year alone, $100 million was blocked. This suggests a sharp uptick in enforcement efforts just as regulators worldwide tighten the screws. LATEST: Tether freezes $12.3M in $USDT tied to suspicious TRON addresses. pic.twitter.com/WJr2ApEfyp — MrRebel.eth (@rebelethpromos) June 16, 2025 Targeting High‑Risk Entities On Sanctions List Following regulatory synchronization with the US Treasury’s Office of Foreign Assets Control (OFAC), Tether regularly blacklists wallets associated with sanctioned entities. Individuals on the Specially Designated Nationals (SDN) list are the natural targets. In March 2025, for example, Tether froze $27 million worth of USDT on the Russian-linked exchange Garantex following the EU’s 16th package of sanctions. Garantex later suspended services and claimed that over 2.5 billion rubles of user funds were held up. Lazarus Group Faces $374K Blacklist Reports show that North Korea’s Lazarus Group has moved more than $3 billion in stolen crypto since 2009. In November 2023, Tether blacklisted $374,000 in USDT tied to Lazarus‑associated addresses. Other stablecoin companies joined together to lock up $3.4 million in identical wallets. These numbers highlight how large issuers can upset state-sponsored hacking groups. Diversifying With Gold Royalties Tether diversified beyond digital currency on June 12, 2025, by buying a 32% equity stake in Elemental Altus Royalties. The deal involved the purchase of over 78 million shares at CAD1.55 per share, valued around $89 million. Related Reading: Record‑High Ethereum Open Interest Signals Institutional Confidence This move to become a public gold royalty company shows Tether’s commitment to backing its stablecoin with real assets. It also shows an effort to appease risk-averse regulators that demand strong reserves. A Dual Approach To Stablecoin Governance As per Tether executives, this combination of tough enforcement and asset diversification can become a new benchmark. By freezing criminal funds and backing USDT with real-world value, Tether aims to strengthen confidence in its stablecoin. Featured image from Unsplash, chart from TradingView Altcoin, altcoins, blockchain, cryptocurrency, digital currency, tether, TRON NewsBTC