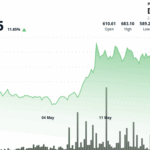

Bitcoin surged to an unprecedented high on Thursday, breaching the $111,000 mark for the first time as a confluence of factors, including growing institutional demand and positive regulatory signals from the US, fueled a wave of bullish sentiment across the cryptocurrency market.

The world’s original cryptocurrency climbed as much as 3.3% on Thursday to achieve a new record of $111,878, according to data compiled by Bloomberg.

This landmark achievement was not isolated, as smaller tokens also caught the updraft; second-ranked Ether, for instance, was up approximately 5.5% at one point during the rally.

A significant undercurrent of optimism is currently buoying Bitcoin.

This has been notably stoked by the recent advancement of a key stablecoin bill in the US Senate, a development that has kindled hopes for greater regulatory clarity for digital-asset firms under President Donald Trump, who has expressed a generally pro-crypto stance.

Alongside these regulatory tailwinds, surging demand from prominent institutional players is acting as a powerful driving force.

Michael Saylor’s MicroStrategy, which has famously stockpiled over $50 billion worth of Bitcoin, leads a growing cohort of entities actively accumulating the token.

“It has been a slow motion grind into new all-time highs,” observed Joshua Lim, global co-head of markets at FalconX Ltd.

There’s no shortage of demand for BTC from SPAC and PIPE deals, which is manifesting in the premium on Coinbase spot prices.

This demand is being met by a diverse group of buyers, including a flurry of lesser-known small-cap companies and newly established public firms led by crypto industry heavyweights, who are financing their Bitcoin acquisitions through various means, from convertible bonds to preferred stocks.

Illustrating this trend, an affiliate of Cantor Fitzgerald LP is reportedly collaborating with stablecoin issuer Tether Holdings SA and SoftBank Group to launch Twenty One Capital Inc., a company designed to emulate MicroStrategy’s Bitcoin-centric business model.

Separately, a subsidiary of Strive Enterprises Inc., co-founded by Vivek Ramaswamy, is in the process of merging with Nasdaq-listed Asset Entities Inc. to form a dedicated Bitcoin treasury company.

Beyond momentum: quantifiable demand fuels rally

Market experts emphasize that the current rally is not solely based on speculative momentum.

“Unlike previous cycles, this rally is not momentum-driven alone,” stated Julia Zhou, COO of crypto market maker Caladan.

It is quantitatively underpinned by measurable, persistent demand and supply dislocations.

This suggests a more fundamentally sound basis for the ongoing price appreciation.

Interestingly, Bitcoin’s outperformance relative to smaller cryptocurrencies, often referred to as altcoins, is widening.

An index tracking these alternative tokens is down approximately 40% year-to-date, while Bitcoin itself has registered a 17% gain so far in 2025, highlighting a flight to perceived quality within the digital asset space.

Activity in the options markets further underscores the bullish sentiment.

Earlier this week, traders built significant Bitcoin positions, with call options at strike prices of $110,000, $120,000, and even an ambitious $300,000, all expiring on June 27, logging the highest open interest (number of outstanding contracts) on the derivatives exchange Deribit.

This activity points to strong expectations of further upside.

Tony Sycamore, a market analyst at IG, remarked in a note that the fresh record high demonstrates that Bitcoin’s sharp decline from a previous peak set on January 20 (to below $75,000 in April) was merely “a correction within a bull market.”

He added, “A sustained break above $110,000 is needed to trigger the next leg higher towards $125,000.”

Political intersections and market perceptions

Bitcoin’s latest milestone coincides with President Trump preparing to meet with major holders of his memecoin at a dinner event at his golf club near Washington on Thursday.

This event has drawn scrutiny from ethics experts, who argue it offers privileged access through transactions that directly benefit the president, thereby sparking criticism over potential conflicts of interest.

While such events contribute to crypto’s growing mainstream presence, their direct market impact is debated.

Yuan Rong Tan, a trader at QCP Capital, commented that such events “highlight crypto’s increasing cultural visibility, though they have not had a measurable impact on market dynamics at this stage.”

The post Bitcoin reaches new all-time high above $111,000 amid regulatory hopes appeared first on CoinJournal.

Bitcoin surged to an unprecedented high on Thursday, breaching the $111,000 mark for the first time as a confluence of factors, including growing institutional demand and positive regulatory signals from the US, fueled a wave of bullish sentiment across the cryptocurrency market. The world’s original cryptocurrency climbed as much as 3.3% on Thursday to achieve

The post Bitcoin reaches new all-time high above $111,000 amid regulatory hopes appeared first on CoinJournal. Markets, Bitcoin News, Ether, USA CoinJournal: Latest Crypto News, Altcoin News and Cryptocurrency Comparison