- Gold has been losing steam recently after it raced to record highs due to geopolitical and economic uncertainties, including tariffs.

- Bitcoin has been the winner, with gold being the loser in a hedge trade against currencies.

- The increasing number of US states and companies buying bitcoin will be another catalyst.

JP Morgan analysts expect Bitcoin to outperform gold for the rest of the year.

The research firm predicts this performance on the back of more US institutions buying Bitcoin and a zero-sum trade where Gold is losing lately.

Gold’s blitz fading

Gold had a strong start to 2025, racing to a 28% gain in its 52-week peak at $3,509.9 per ounce on April 22.

At that time, Bitcoin was down 3% for the year till then.

This rally was largely fueled by heightened geopolitical tensions, escalating US-China trade tensions, and persistent global recession fears fueled by tariffs, which drove significant safe-haven buying.

Central bank purchases also played a role in this upward trajectory.

A JP Morgan analyst in an earlier note said that momentum in gold’s price could push it to $6,000 over the next four to five years.

This surge would be fueled by a change in investors’ preference towards US investments.

A debasement trade where investors buy gold and Bitcoin as a hedge against weakening international currencies has turned into a zero-sum game in 2025, JP Morgan analysts noted.

Gold was the asset that was gaining, and Bitcoin was losing in this arrangement until recently, they said.

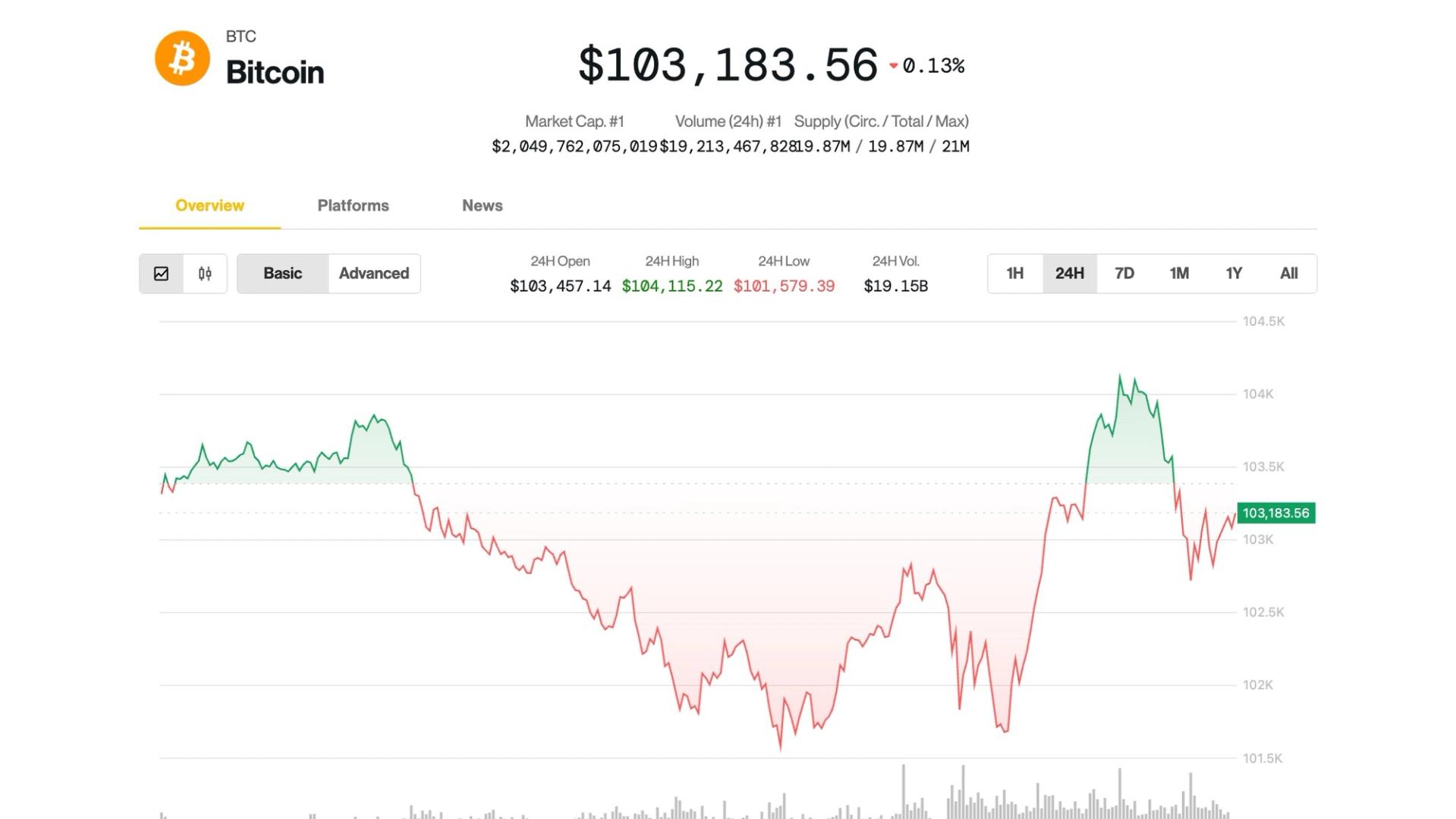

Since April’s peak, Gold prices have declined by 8% while Bitcoin has gained by 18%.

The analysts noted that this performance has reflected in investor appetite as well.

Data indicating the flow of money showed that money was taken out of gold exchange-traded funds (ETFs) and being poured into spot bitcoin and crypto funds since April, JP Morgan said.

Bitcoin ETFs have attracted over $40 billion in inflows since their approval in 2024.

In futures data, the gold position has declined while bitcoin has been trending upwards.

Catalyst for Bitcoin

The surge in Bitcoin price was also supported by companies and US institutions, either buying the crypto asset or encouraging the buying with supporting regulations.

Strategy, a business intelligence company, has plans to buy $84 billion worth of bitcoin by 2027 in two separate $42 billion plans.

The company said it has already met 60% of the first $42 billion buying project.

Prominent hedge funds like Citadel, Millennium, and Susquehanna have also invested in the crypto asset.

Major companies like Tesla, Coinbase, Block, and MetaPlanet have also added Bitcoin to their reserves.

US states are also buying bitcoin to pad their reserves. New Hampshire recently became the first US state to pass a crypto bill.

Under the new rule, the state can invest up to 10% of its public funds in Bitcoin and precious metals.

Arizona also passed a Bitcoin reserve bill into law and promises no increased taxes.

Analysts said that as more US states make rules to invest in Bitcoin, it could act as a “sustained positive” catalyst for Bitcoin.

The post Bitcoin to outperform gold in second half of 2025: JP Morgan appeared first on CoinJournal.

Gold has been losing steam recently after it raced to record highs due to geopolitical and economic uncertainties, including tariffs. Bitcoin has been the winner, with gold being the loser in a hedge trade against currencies. The increasing number of US states and companies buying bitcoin will be another catalyst. JP Morgan analysts expect Bitcoin

The post Bitcoin to outperform gold in second half of 2025: JP Morgan appeared first on CoinJournal. Markets, Bitcoin Gold News, Crypto, gold CoinJournal: Latest Crypto News, Altcoin News and Cryptocurrency Comparison