Cardano’s ADA and XRP led losses among majors on Tuesday as traders await the outcome of the upcoming Federal Reserve (FOMC) meeting, where rates are expected to stay unchanged but Fed chair Jerome Powell’s comments could provide cues on further market positioning.

Bitcoin (BTC) prices held above $94,000 after briefly dipping below that level on Sunday, continuing its recent range-bound behavior.

ADA price dropped nearly 4% while XRP slid similarly. Ether (ETH) fell nearly 1%, BNB Chain’s BNB rose 1.3% and memecoin dogecoin (DOGE) was down 2% in the past 24 hours.

The broad-based CoinDesk 20 (CD20), a liquid index that tracks the largest tokens by market capitalization, dropped a little over 1.8%.

Elsewhere, some DeFi tokens such as AAVE, Curve’s CRV, and Hyperliquid’s HYPE have seen a bump in demand over the past week in a sign of trader interest toward projects with utility and yield mechanisms, some say.

“As memecoins fall out of favor, traders are turning to projects with stronger fundamentals and token economics,” said Kay Lu, CEO of HashKey Eco Labs, told CoinDesk in a Telegram message.

“DeFi ecosystems are benefiting from this pivot, especially as Bitcoin shows decreased volatility and macro uncertainty lingers. We’re hopeful to see the DeFi trend continue as Bitcoin maintains decreased volatility and crypto acts as a hedge for economic uncertainty,” Lu added.

HYPE led gains among the top 100 tokens with a 72% surge in the past week, with AAVE and CRV up as much as 40%.

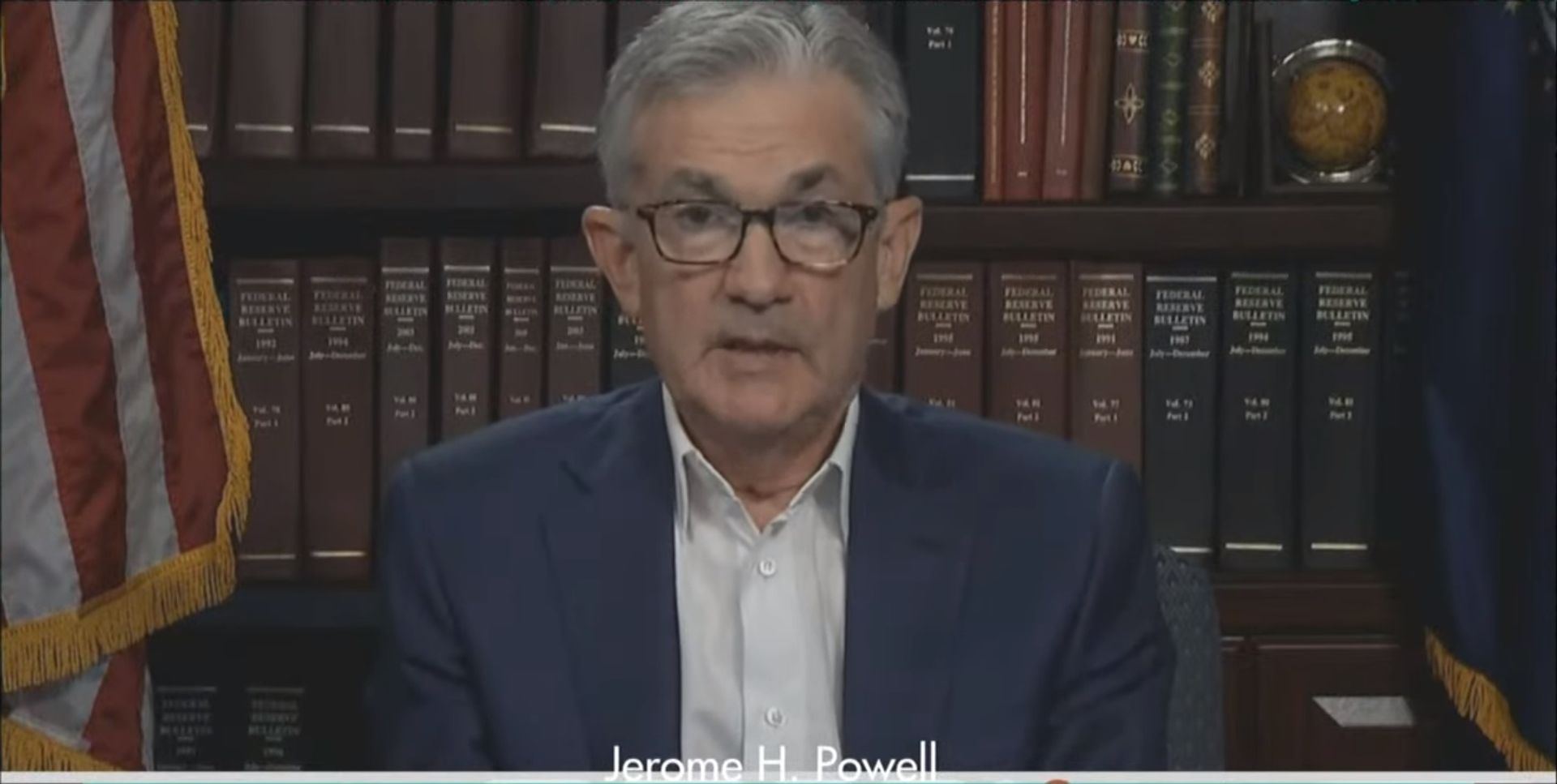

Powell’s comment in focus

Traders across both crypto and traditional finance markets are eyeing this week’s FOMC interest rate decision, with consensus expectations pointing to a pause in rate hikes.

However, uncertainty around inflation, tariffs, and the broader U.S.–China trade tensions has left many participants cautious.

“We don’t expect the FOMC to trigger a major move in markets,” said Augustine Fan, Head of Insights at SignalPlus, in a Telegram message. “It’s a coin flip on direction. Crypto will likely take cues from broader earnings growth and how the economy digests the impact of recent trade policies.”

Recent stock market strength suggests that investors are pricing in only a mild recession risk, around 8%, according to historical drawdown models. That contrasts with more bearish signals from bond markets and macroeconomic forecasts, Fan added.

Last week, President Trump confirmed no immediate plans for talks with China, dampening hopes for a breakthrough in U.S.–China trade negotiations. Still, the possibility of separate trade agreements has helped keep risk sentiment intact, as reported Monday.

DeFi tokens such as Hyperliquid’s HYPE are up 70% in the past week, a sign of traders favoring fundamentals as capital allocators remain cautious with their money. Markets, Cardano, XRP, Bitcoin, FOMC, Top Stories, News CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data