Ether extended its rally Monday as institutional demand surged and exchange supply dropped to a multi-year low.

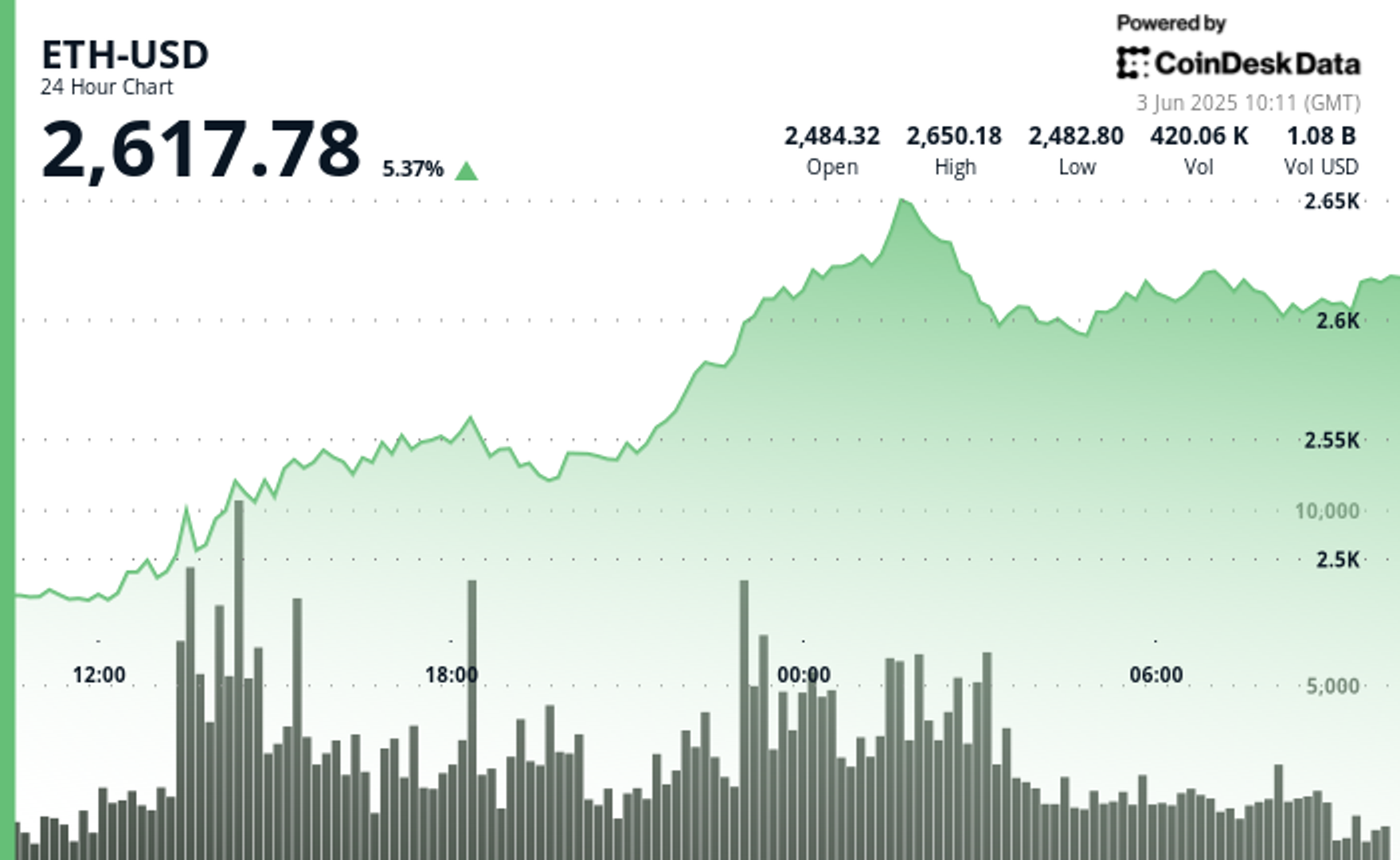

The asset climbed as high as $2,650.18 before easing to around $2,617, where it currently trades, according to CoinDesk Research’s technical analysis data model.

Despite the minor retracement, ETH remains one of the best-performing major tokens this week, supported by $321 million in fresh inflows into ether-linked investment products. That’s the strongest weekly inflow figure since December, reflecting mounting investor confidence in ether’s long-term value.

Analysts also highlight a drop in ETH held on centralized exchanges, which suggests a shift toward self-custody and accumulation.

Technical Analysis Highlights

- ETH logged a 24-hour range of $172.87 (6.97%), peaking at $2,650.18.

- Key resistance at $2,550 was breached with 288K ETH in trading volume.

- Current price action shows consolidation above $2,600 after a modest pullback.

- Support is forming around $2,610–$2,615, with bulls defending the $2,600 level.

- A sharp volume spike at 07:58 (see chart) coincided with a brief dip to $2,609.

- Overall trend remains bullish as higher lows continue to hold.

Ether remains elevated after spot ETH ETFs saw their largest weekly inflow of 2025, lifting confidence even as momentum cools above $2,600. Markets, AI Market Insights, Technical Analysis, Ethereum, ETH, News CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data