Solana is under pressure after failing to reclaim the $180 level, pulling back as part of a broader market correction. The recent rejection highlights a key resistance zone that bulls have been unable to overcome. As global markets experience increased volatility due to rising geopolitical tensions and ongoing trade disputes between major economies like the US and China, risk assets—including crypto—are consolidating or retracing.

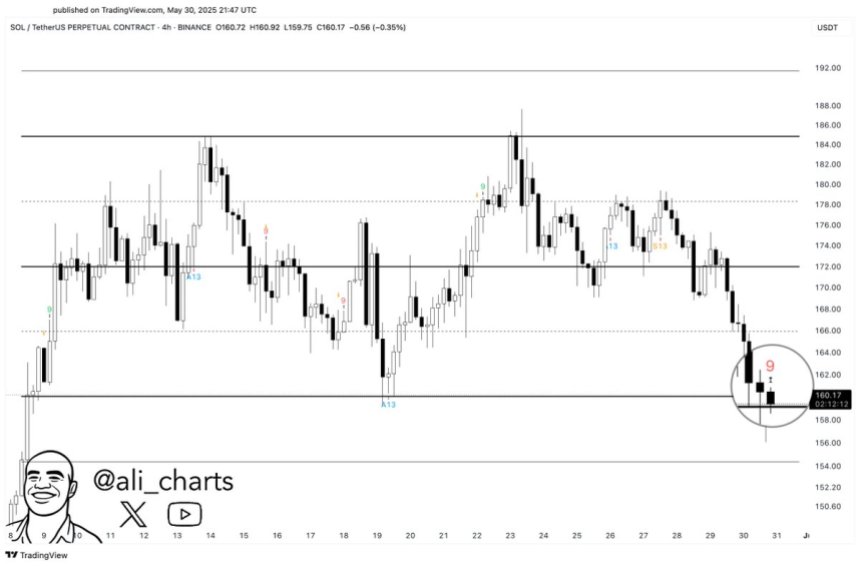

Despite the pullback, top analyst Ali Martinez believes Solana could still be poised for a rebound. In a recent analysis, Martinez pointed out that as long as SOL holds above the $159 support level, the asset maintains a structurally bullish outlook. This zone now serves as a key threshold for the bulls to defend in the short term.

If Solana finds enough demand at these levels, it could set the stage for a sharp recovery and renewed attempts at breaking above $180. For now, the market remains tense, with traders watching both macroeconomic developments and technical levels closely. SOL’s ability to hold critical support may determine whether it joins the next leg of a potential altcoin rally or slides into a deeper correction.

Solana Consolidates Quietly

While much of the market’s attention remains locked on Bitcoin and Ethereum, Solana has been quietly consolidating in a tight range below the $180 resistance. The lack of volatility in recent days may seem uneventful, but analysts warn that this calm could be the precursor to a sharp breakout.

As the broader market digests macroeconomic uncertainty and prepares for a potential altseason, Solana’s technical setup suggests it may be one of the first major altcoins to move.

Martinez recently shared an optimistic outlook for Solana, highlighting the importance of the $159 support level. As long as SOL holds this zone, the structure remains bullish. Martinez also noted that the TD Sequential indicator has flashed a buy signal on the chart, typically seen during the final stages of a retracement before a new impulse begins. This aligns with the current low-volume, sideways environment that often precedes large price expansions.

If Solana breaks above the $180 resistance with strong momentum, the move could spark an aggressive rally toward previous highs. Given its strong fundamentals, vibrant ecosystem, and historical leadership during bullish phases, Solana is well-positioned to lead if the market transitions into a full-fledged altseason.

Solana Tests Support As Market Corrects

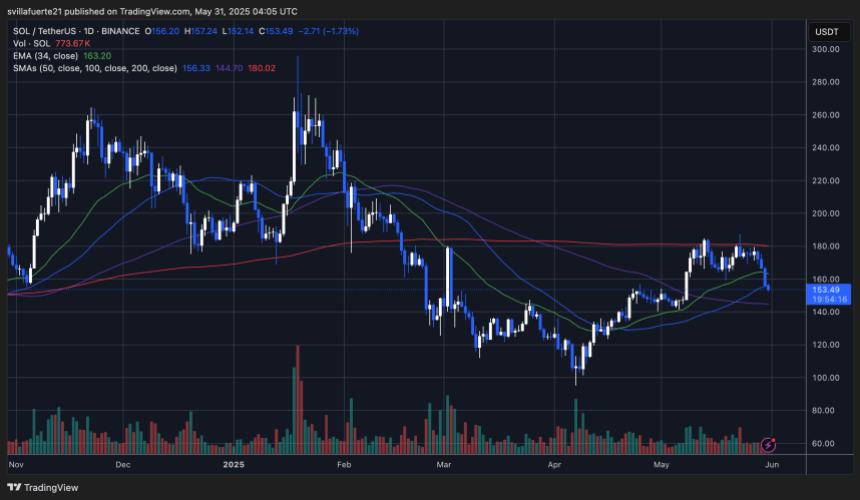

Solana (SOL) is currently trading around $153.49 after failing to reclaim the $180 resistance zone. The daily chart shows a sharp decline over the past few sessions, with price breaking below the 34-day EMA at $163.20. This move highlights growing bearish momentum and places the spotlight on the $150–$156 support range, where the 50-day and 100-day SMAs converge.

Volume has ticked higher during this drop, suggesting stronger selling pressure as traders de-risk amid broader market uncertainty. The failure to hold above key moving averages weakens the short-term bullish outlook, though the structure hasn’t fully broken down yet. If SOL manages to stabilize above $150, this zone could act as a base for a rebound.

However, continued weakness below this level may lead to a retest of lower support zones around $144 and $135. That said, RSI levels suggest Solana is approaching oversold territory on lower time frames, hinting that buyers could step in soon.

For a bullish reversal, SOL needs to reclaim the $163 level and push above the $180 resistance. Until then, traders should watch the $150–$159 range closely, as holding this zone is critical for Solana’s next leg in either direction.

Featured image from Dall-E, chart from TradingView

Solana is under pressure after failing to reclaim the $180 level, pulling back as part of a broader market correction. The recent rejection highlights a key resistance zone that bulls have been unable to overcome. As global markets experience increased volatility due to rising geopolitical tensions and ongoing trade disputes between major economies like the US and China, risk assets—including crypto—are consolidating or retracing. Related Reading: Ethereum Pulls Back To 20DMA After $2,700 Rejection: Testing Strength At Key Support Despite the pullback, top analyst Ali Martinez believes Solana could still be poised for a rebound. In a recent analysis, Martinez pointed out that as long as SOL holds above the $159 support level, the asset maintains a structurally bullish outlook. This zone now serves as a key threshold for the bulls to defend in the short term. If Solana finds enough demand at these levels, it could set the stage for a sharp recovery and renewed attempts at breaking above $180. For now, the market remains tense, with traders watching both macroeconomic developments and technical levels closely. SOL’s ability to hold critical support may determine whether it joins the next leg of a potential altcoin rally or slides into a deeper correction. Solana Consolidates Quietly While much of the market’s attention remains locked on Bitcoin and Ethereum, Solana has been quietly consolidating in a tight range below the $180 resistance. The lack of volatility in recent days may seem uneventful, but analysts warn that this calm could be the precursor to a sharp breakout. As the broader market digests macroeconomic uncertainty and prepares for a potential altseason, Solana’s technical setup suggests it may be one of the first major altcoins to move. Martinez recently shared an optimistic outlook for Solana, highlighting the importance of the $159 support level. As long as SOL holds this zone, the structure remains bullish. Martinez also noted that the TD Sequential indicator has flashed a buy signal on the chart, typically seen during the final stages of a retracement before a new impulse begins. This aligns with the current low-volume, sideways environment that often precedes large price expansions. If Solana breaks above the $180 resistance with strong momentum, the move could spark an aggressive rally toward previous highs. Given its strong fundamentals, vibrant ecosystem, and historical leadership during bullish phases, Solana is well-positioned to lead if the market transitions into a full-fledged altseason. Related Reading: Ethereum Daily Gas Usage Hits New Highs – Real Demand Powers ETH Growth Solana Tests Support As Market Corrects Solana (SOL) is currently trading around $153.49 after failing to reclaim the $180 resistance zone. The daily chart shows a sharp decline over the past few sessions, with price breaking below the 34-day EMA at $163.20. This move highlights growing bearish momentum and places the spotlight on the $150–$156 support range, where the 50-day and 100-day SMAs converge. Volume has ticked higher during this drop, suggesting stronger selling pressure as traders de-risk amid broader market uncertainty. The failure to hold above key moving averages weakens the short-term bullish outlook, though the structure hasn’t fully broken down yet. If SOL manages to stabilize above $150, this zone could act as a base for a rebound. However, continued weakness below this level may lead to a retest of lower support zones around $144 and $135. That said, RSI levels suggest Solana is approaching oversold territory on lower time frames, hinting that buyers could step in soon. Related Reading: Altseason Loading? Analyst Explains How FTX $5B Distribution May Trigger The Next Bull Leg For a bullish reversal, SOL needs to reclaim the $163 level and push above the $180 resistance. Until then, traders should watch the $150–$159 range closely, as holding this zone is critical for Solana’s next leg in either direction. Featured image from Dall-E, chart from TradingView Solana, Sol, Solana Analysis, Solana Bullish, Solana Buy Signal, Solana news, Solana Support, SOLUSDT NewsBTC