Bitcoin approached the $100,000 threshold on Wednesday after teasing a big international trade deal by US President Donald Trump. The agreement, as reported by The New York Times, will be with the United Kingdom and is to be formally announced at the White House on Thursday.

The cryptocurrency was at $99,200 as of publication, having risen from $97,100 when Trump initially posted about the deal on his Truth Social page. The post, published on May 7, stated that a “big trade deal” with a “highly respected” nation would be announced on May 8. Sources familiar with the situation indicated to The New York Times that the deal is with the UK.

Speculation Linked To Bitcoin’s Rise

Some Bitcoin observers think the trade deal has helped drive prices higher. FOMO21 co-founder Neil Jacobs wrote on X that Trump’s message was probably the main reason Bitcoin began rising.

BITCOIN PUMPING, WHY???

TRUMP: BIG NEWS CONFERENCE TOMORROW 10AM EST IN OVAL, MAJOR TRADE DEAL WITH A BIG & HIGHLY RESPECTED COUNTRY pic.twitter.com/QjHM95kXrE

— Neil Jacobs (@NeilJacobs) May 8, 2025

Bitcoin reached its latest high of $109,000 on January 20. That was only hours after Trump was inaugurated for his second term. Now, traders are holding their breath to see if this new wave of optimism will propel the coin to new highs.

Market Sentiment Turns Greedy

The mood in the crypto market has changed. According to statistics from the Crypto & Fear Index, the sentiment is now “Greed” with a reading of 65. That indicates that most investors are optimistic and ready to take higher risks.

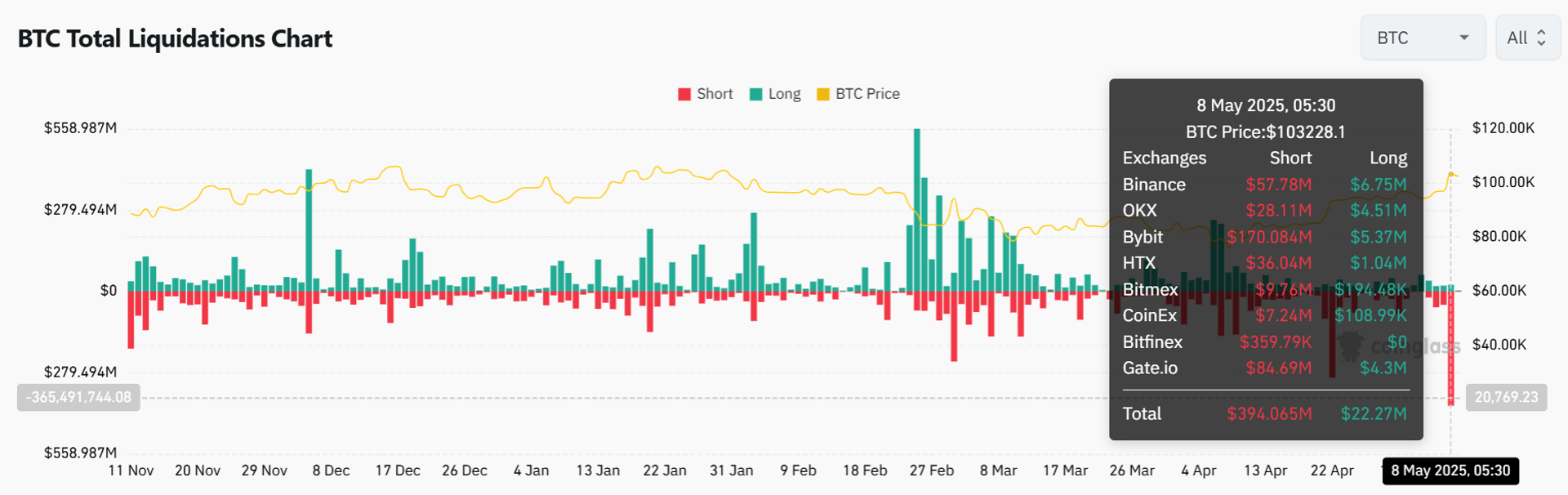

Meanwhile, Bitcoin’s recent 3% increase has caused approximately $96 million worth of short positions to be liquidated, as reported by CoinGlass. Short liquidations occur when bettors against Bitcoin are compelled to close their wagers because of price increases.

Rates Remain Flat As Trump Resists

Trump’s tweet saw print just a few hours after the US Federal Reserve chose to maintain interest rates as they were. The prevailing rate range is between 4.25% and 4.50%. Trump had been pushing the Fed to reduce rates, but the central bank made no move.

As the Fed held firm, Bitcoin continued rising. That might be an indicator that investors are giving more credibility to trade reports and international politics than central bank policy—at least in the meantime.

BTC Action Tracks Tariff Tensions

All the way back on February 1, Bitcoin topped $100,000 following Trump’s statement of new import tariffs on nations such as China, Canada, and Mexico. That was the last time that BTC was above six figures.

Meanwhile, Bitcoin’s trajectory is still uncertain. But as political news gets hotter, investors are keeping close tabs of the news—and paying attention to the chart.

Featured image from Gemini Imagen, chart from TradingView

Bitcoin approached the $100,000 threshold on Wednesday after teasing a big international trade deal by US President Donald Trump. The agreement, as reported by The New York Times, will be with the United Kingdom and is to be formally announced at the White House on Thursday. Related Reading: XRP At $2.20? Analyst Insists It’s Not Too Late To Get In The cryptocurrency was at $99,200 as of publication, having risen from $97,100 when Trump initially posted about the deal on his Truth Social page. The post, published on May 7, stated that a “big trade deal” with a “highly respected” nation would be announced on May 8. Sources familiar with the situation indicated to The New York Times that the deal is with the UK. Speculation Linked To Bitcoin’s Rise Some Bitcoin observers think the trade deal has helped drive prices higher. FOMO21 co-founder Neil Jacobs wrote on X that Trump’s message was probably the main reason Bitcoin began rising. 🚨BITCOIN PUMPING, WHY??? TRUMP: BIG NEWS CONFERENCE TOMORROW 10AM EST IN OVAL, MAJOR TRADE DEAL WITH A BIG & HIGHLY RESPECTED COUNTRY pic.twitter.com/QjHM95kXrE — Neil Jacobs (@NeilJacobs) May 8, 2025 Bitcoin reached its latest high of $109,000 on January 20. That was only hours after Trump was inaugurated for his second term. Now, traders are holding their breath to see if this new wave of optimism will propel the coin to new highs. Market Sentiment Turns Greedy The mood in the crypto market has changed. According to statistics from the Crypto & Fear Index, the sentiment is now “Greed” with a reading of 65. That indicates that most investors are optimistic and ready to take higher risks. Source: Alernative.me Meanwhile, Bitcoin’s recent 3% increase has caused approximately $96 million worth of short positions to be liquidated, as reported by CoinGlass. Short liquidations occur when bettors against Bitcoin are compelled to close their wagers because of price increases. Rates Remain Flat As Trump Resists Trump’s tweet saw print just a few hours after the US Federal Reserve chose to maintain interest rates as they were. The prevailing rate range is between 4.25% and 4.50%. Trump had been pushing the Fed to reduce rates, but the central bank made no move. As the Fed held firm, Bitcoin continued rising. That might be an indicator that investors are giving more credibility to trade reports and international politics than central bank policy—at least in the meantime. Related Reading: Bitcoin Mining Giant Abandons Full-Hold Strategy, Unloads $40M In Crypto BTC Action Tracks Tariff Tensions All the way back on February 1, Bitcoin topped $100,000 following Trump’s statement of new import tariffs on nations such as China, Canada, and Mexico. That was the last time that BTC was above six figures. Meanwhile, Bitcoin’s trajectory is still uncertain. But as political news gets hotter, investors are keeping close tabs of the news—and paying attention to the chart. Featured image from Gemini Imagen, chart from TradingView Bitcoin News, bitcoin, btc, btcusd, crypto, tariffs, Trump, uk, us NewsBTC