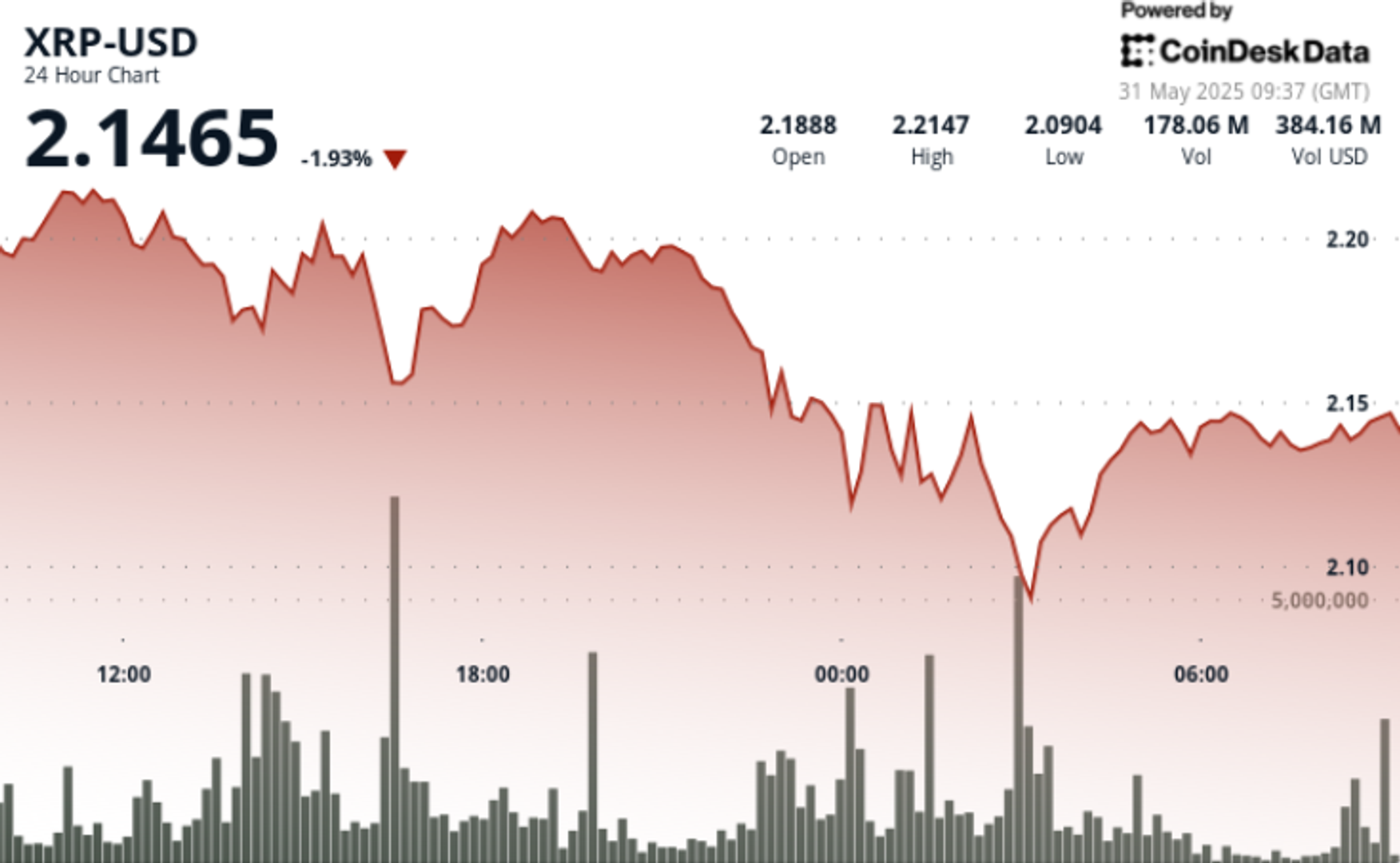

XRP fell as much as 6% over the past 24 hours as global economic tensions rattled financial markets, triggering a wave of liquidations and pushing prices below key support levels.

The token dropped from $2.20 to $2.14 as the broader crypto market shed 3.81% of its value, settling at a total market cap of $3.3 trillion.

The volatility comes in the wake of the U.S. Court of International Trade’s decision to overturn Trump’s trade tariffs, reigniting trade policy concerns and sending ripples across risk assets.

XRP wasn’t immune, with over $29.68 million in long positions liquidated as traders scrambled to adjust their exposure.

News Background

- China-based Webus International said Friday it plans to raise up to $300 million through non-equity financing to support its global chauffeur payment network with an XRP reserve.

- The initiative aims to integrate XRP’s cross-border settlement capabilities into Webus’ ecosystem, including on-chain booking records and a Web3-based loyalty program.

- Webus is renewing its partnership with Tongcheng Travel Holdings to use the XRP Ledger for settling cross-border rides and driver payouts.

- Bitget listed Ripple’s RLUSD stablecoin late Thusday.

- Ripple published a cross-border payments report on Friday. Cross-border payments underpin the $31.6 trillion B2B market, projected to hit $50 trn by 2032. Traditional multi-intermediary rails are slow, costly and opaque, facing regulatory and transparency hurdles.

- Blockchain-based solutions like Ripple’s stablecoin network promise near-instant, cheaper, visible settlement, enhancing liquidity, global expansion, talent payments and customer trust, while reducing failed transfers, the report said.

Price-Action

Technically, XRP found strong selling pressure at the $2.21 resistance level, failing to mount a sustained recovery. A notable support zone emerged near $2.11, with high-volume buying during the 03:00 hour preventing further downside.

Recent consolidation between $2.13 and $2.14 suggests potential stabilization — though the pattern of lower highs indicates sellers remain in control.

In the final trading hour, XRP formed a higher-low pattern around $2.135, signaling potential short-term support.

However, the token also faced resistance at $2.144-$2.145, forming a tight range that traders will be watching closely for the next breakout or breakdown.

Technical Analysis Recap

- XRP dropped 5.7% from $2.20 to $2.14 over the past 24 hours.

- A price range of $0.13 (5.9%) was observed between a high of $2.22 and a low of $2.09.

- Significant resistance formed at $2.21 during the 16:00 and 22:00 hours, triggering heavy selling.

- Strong buying at $2.11 during the 03:00 hour prevented further downside.

- Recent consolidation between $2.13 and $2.14 suggests potential stabilization, though lower highs persist.

- A higher low at $2.135 formed in the last hour, with resistance at $2.144-$2.145 capping any rebound.

- XRP closed the session at $2.137, indicating consolidation after a volatile day.

As XRP navigates the crosswinds of macroeconomic tensions and technical headwinds, traders will be closely watching for any signs of sustained support or further breakdown.

XRP’s 4% drop highlights market uncertainty as global trade tensions and liquidations weigh on investor sentiment. Markets, AI Market Insights, News CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data